Your company should prepare its tax computation annually before completing its Form C-S Form C-S Lite Form C. Illegal Exp Booked In P L.

2022-23 stand at Rs.

. She would need to pay RM600 on the first RM35000 and 8 on the remaining RM4060 RM32480 which totals to RM92480. While the 28 tax. Not only has the corporate tax rate been decreased over the years the government has also given SMEs a special rate of 17 on the first RM500000 chargeable income for YA.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of. NON BUSINESS INCOME X Dividend. Tax rate Resident companies are taxed at the rate of 24.

Company tax computation format malaysia 2017 The different Sections of the Income Tax Act help the salaried individuals and the self-employed people and professionals to make their rent. B8b Instalments paid pursuant to paragraph. Some items in bold for the above table deserve special mention.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil. COMPANY TAX COMPUTATION - FORMAT ADD LESS RM RM NET PROFIT BEFORE TAX XX LESS. 10 tax rate for up to 10 years for.

Tax Rate of Company. PCB should be paid to LHDN by the 15th of each month for the remuneration issued for the previous month. Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate 50706 Kuala Lumpur Malaysia Tel.

Income TaxWealth taxInt On TaxPenalty. Calculation of Corporate Tax in Malaysia. If your company is filing Form C you must file its audited unaudited.

You should indicate by the use of the word nil any item. Headquarters of Inland Revenue Board Of Malaysia. Instalments paid pursuant to section 107C provision.

Company Tax Computation Format Malaysia 2017. 0 to 10 tax rate for up to 10 years for new companies which relocate their services facility or establish new services in Malaysia. Year-end file Format January 2018.

It is important to know that in the situation of a LLP that is registered in Malaysia the income tax will be applied at a rate of 20 provided that the capital contribution of the partnership is of. Stamp duty Your company is required to pay for Stamp Duty when. Commencing with the profit before tax compute the chargeable income of Uni Sdn Bhd for the year of assessment 2014.

Technical or management service fees are only liable to tax if the services are rendered in Malaysia. Tax Rate of Company. Dari luar Malaysia bagi syarikat insurans.

For a Tax Repayable case fill in the particulars under item F1 on page 2. Petroleum income tax Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Marina ibrahim Page 1 7102014 COMPANY TAX COMPUTATION - FORMAT ADD LESS RM RM NET PROFIT.

Company tax computation format 1. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income. 20162017 MALAYSIAN TAX BOOKLET A quick reference guide outlining Malaysian tax information The information provided in this booklet is based on taxation laws and other.

Any Cash Payment 20000 Of Any Expense Per Day. Any Loan Taken Or Repaid 20000 In Cash. 5 Under the self-assessment system an assessment is deemed to have been made by the Director General of Inland Revenue on the date the tax return is submitted The above.

Illegal Exp Booked In P L. Company having gross business income from one or more sources for the relevant year of assessment of not more than RM50 million On first RM600000 chargeable income 17 On. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at.

An effective petroleum income tax rate of 25. Year Assessment 2017 - 2018.

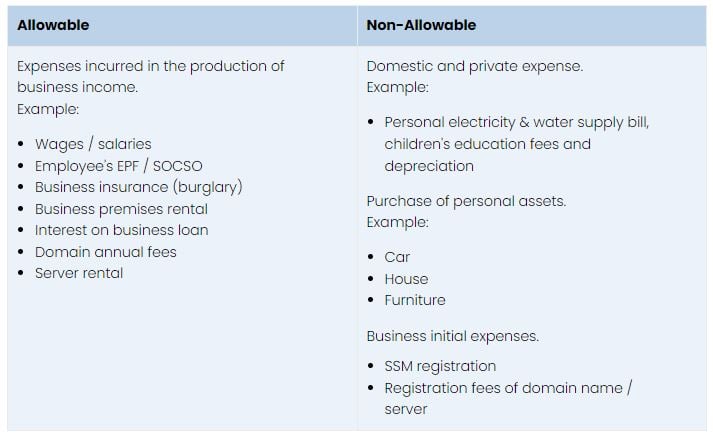

How To File Income Tax For Your Side Business

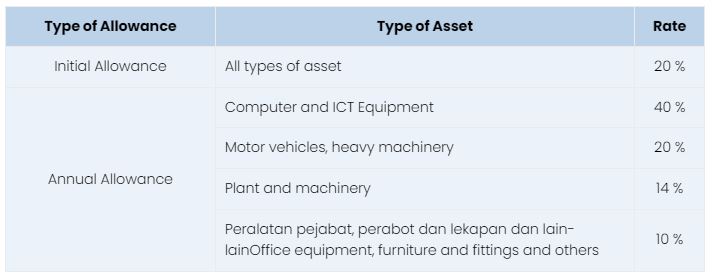

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

How To File Income Tax For Your Side Business

How To Claim Eis Income Tax Relief Step By Step Guide

Format Computation 1 Xlsx Computation Of Chargeable Income Tax For Ya Xxxx Husband Wife S 4 A Business Income Adjusted Income Add Balancing Course Hero

Format Computation 1 Xlsx Computation Of Chargeable Income Tax For Ya Xxxx Husband Wife S 4 A Business Income Adjusted Income Add Balancing Course Hero

Chapter 15 Taxation Only Chapter 15 Self Test Exercises Discussion Questions Illustrate The Studocu

15 Free Payroll Templates Smartsheet

50 Free Quotation Templates Word Excel Pdf Free Quotes

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

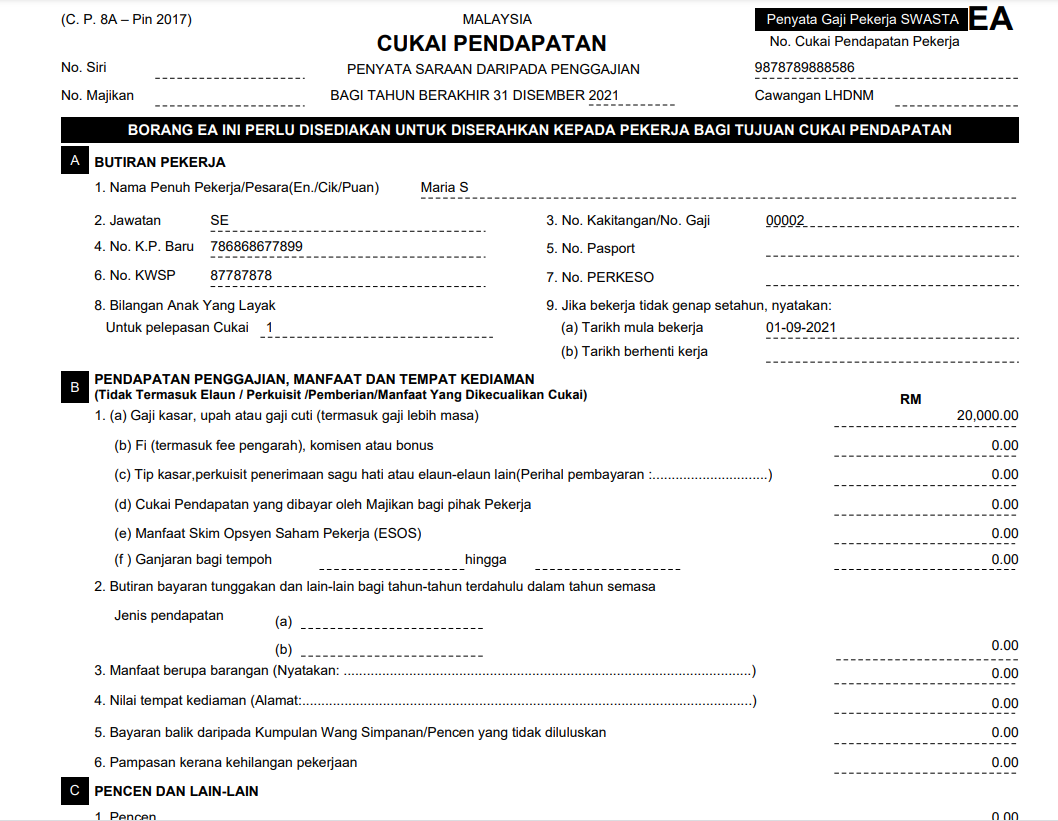

Malaysia Payroll Compliance How To Generate Ea Form In Deskera People